Every day we’re seeing newspaper and TV reports about the dire state many find themselves in across the UK. You would be hard pressed to find anyone not affected by this. Customers need a flexible way to pay right now that’s not wholly reliant on credit.

No doubt businesses are feeling the pinch as people scale down and tighten belts. It’s going to be a very bumpy road ahead, even Uber has thrown its hat in the ring by offering discounts on fares and food delivery to offset the downturn in orders.

Buy Now Pay Later (BNPL) has given us a glimpse into the need for flexible payments. With BNPL, customers can buy goods on credit through a ‘soft credit check’ and pay for them in interest-free instalments agreed for a specific period. While this option can seem like a blessing, there’s been a steady increase in the amount of people buying groceries on instalments. Citizens Advice reported that one in 12 people are buying groceries through BNPL schemes. With surging energy costs, BNPL provider Zilch is also offering customers a four-part instalment plan to pay for energy bills.

This however does not come without any risks. Calls have been made for the industry to become regulated, with the Financial Conduct Authority (FCA) working with BNPL providers on their terms and conditions. For now, accountability sits with BNPL providers themselves and while initial instalment agreements are interest free, defaults come at a cost.

Research last year by Credit Karma found that “Britons had spent a combined £5.79 billion via BNPL, with £4.12 billion of this still left to repay. Furthermore, it found that nearly half of BNPL shoppers admit to falling behind on payments.”

Appetite

With BNPL being the fastest growing industry in the UK, this proves that there is appetite for flexible instalment payments. Tech giant Apple shook the market when they announced the launch of their Pay Later iOS 16 feature, which will be limited to the US for now. Interest-free four-month loan payments will be available using their Apple Pay service.

Open Banking is set to go live with Variable Recurring Payments (VRPs) this summer. While sweeping VRPs will give a customer the ability to move money from one of their accounts to another; non-sweeping or Commercial VRPs will unlock game-changing use cases. However, there’s no release date for this yet.

We’ve recognised the need for flexible payments and have rolled out with Request with Vyne, a product that can not only unlock instalment payments for merchants, but also provides a way for customers to pay that’s not reliant on credit.

William Hand, Senior Product Manager @ Vyne:

“Consumers now expect a seamless checkout experience in a way that suits them. VRPs can help address these challenges, but with some time until mass market availability we’re excited to bring friction-free checkout alongside flexible payment options to merchants today through Request with Vyne.”

How does Request with Vyne work for merchants

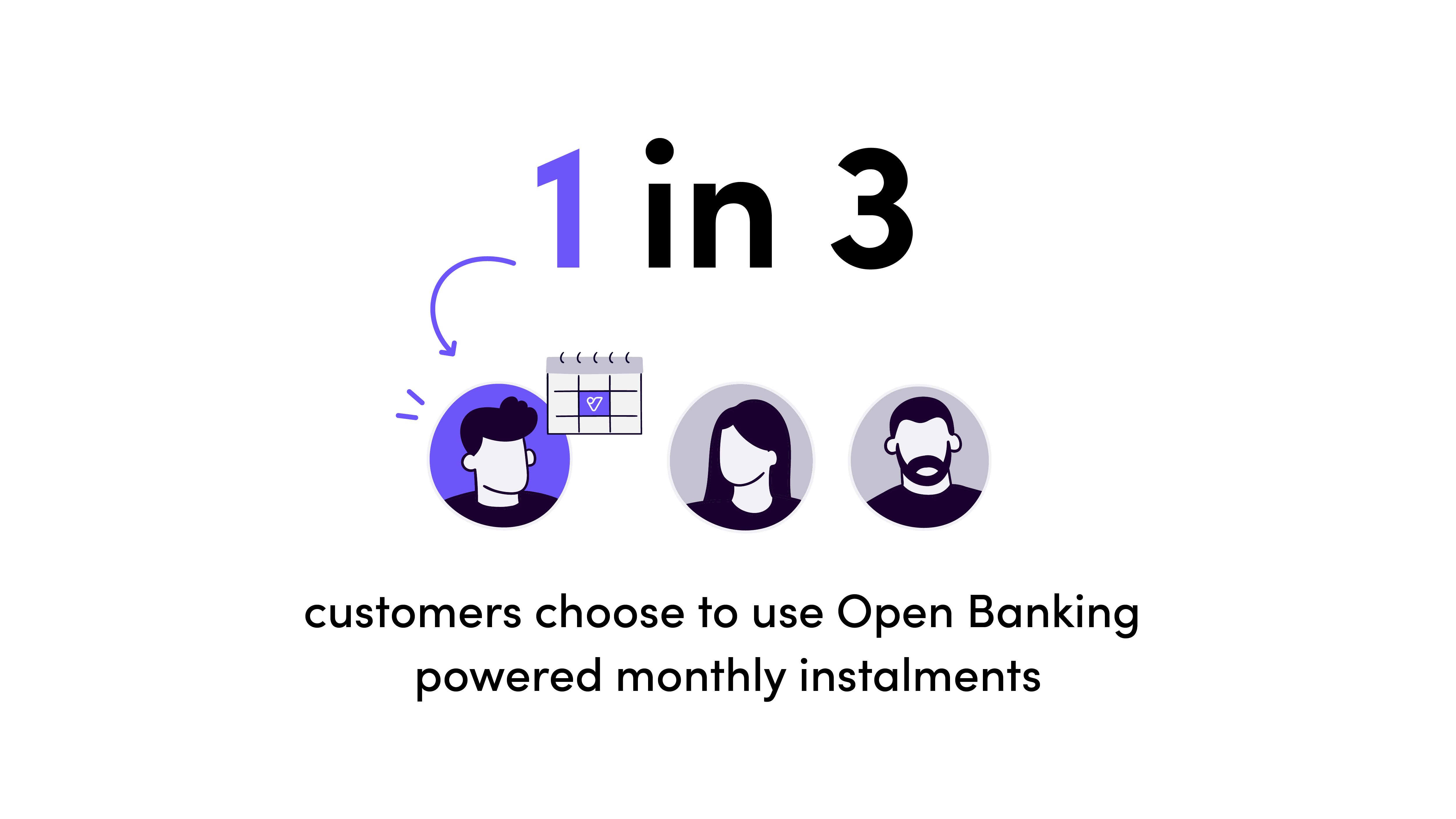

"1/3 of customers are using it today, but we think it's going to go up to 60%"

"1/3 of customers are using it today, but we think it's going to go up to 60%"

Rob Tominey - Chairman + Co-Founder Mainstage Festivals