There’s so much noise in the industry right now about VRPs, so we thought we'd shed some light on where things stand and what is actually possible, and share a potential timeline so you’ll be ready when VRPs start making their mark.

Variable Recurring Payments (VRPs) let customers safely connect authorised payments providers to their bank account so that they can make payments on the customer’s behalf, in line with agreed limits. VRPs offer more control and transparency than existing alternatives, such as Direct Debit payments. – Open Banking

Mike Chambers, payments thought leader and member of Vyne’s Industry Advisory Panel:“In the UK, the first use of VRPs will be for sweeping funds between accounts; however, not surprisingly, the introduction of a new payment type with limited application in its first iteration has caused confusion.

This first use of VRPs follows a Competition and Markets Authority (CMA) mandate passed in July 2021 for the use of Variable Recurring Payments (VRPs) as the mechanism for implementing Sweeping within Open Banking.

Sweeping is defined as the automatic transfer of money between a customer’s own accounts. Although other banks can participate, the introduction of a sweeping based VRP has been mandated on the banks known as the “CMA9” and will be free to use, free to access and is due for launch in summer 2022.”

What, when and why

There’s a lot of talk in the market about VRPs and the benefits they‘ll deliver to the industry. VRPs are set to become a core part of the Open Banking offering, integrating and adding even more benefits to account-to-account (A2A) payments by unlocking more use cases in the future.

In fact, we believe that VRPs will create a game-changing experience by making payment journeys even more seamless and faster, rivalling the likes of Apple Pay (we said what we said!).

There are two types of VRPs. The first is sweeping, which is set to go live this summer. It has been mandated by the Competition and Markets Authority (CMA) to the CMA9, which is made up of the top nine banks in the UK. Sweeping VRPs will be provided to consumers and regulated Open Banking providers at no cost.

To sweep or not to sweep …

Essentially, sweeping is the automatic transfer of money between a consumer’s own accounts. Sweeping can be used by a consumer to repay a loan or move money into a savings account.

Sweeping will be free for merchants to use and access, and will launch in summer 2022, but there are limited use cases for consumers. While this is a major milestone for Open Banking, this probably doesn't address the needs of many merchants outside of financial money management apps. This might leave many frustrated, considering the amount of coverage VRPs are getting in the media.

Sweeping VRPs use cases:

Consumers can move money between current account providers and avoid going into an overdraft.

Consumers can move money to accounts that are used for unbundling overdrafts from a current account and other alternative forms of credit that closely compete with overdrafts.

Consumers can move money to accounts that are used for loan repayments as part of a service that provides alternative forms of credit to an overdraft.

Consumers can move money to a credit card account, and move money to a cash savings account that is capable of paying interest.

But wait, we also have non-sweeping VRPs. Exciting? Absolutely! But will it be ready anytime soon? Non-sweeping VRPs or Commercial VRPs are optional for all banks to implement and will come at a cost for merchants.

This cost has not been set and it’s unclear on whether this will be set by individual banks or industry-wide. There is a lack of clarity around not only dates and costs but also what merchant liability will look like. However, CMA9 has not been mandated to deliver non-sweeping VRPs.

Non-sweeping use cases:

Direct Debit replacements (bill payments)

Subscription payments

Recurring ad hoc payments (in-app purchases)

B2B accounts payable

Card on file replacements

Instant one-off payments

What the timeline could look like

The rollout of VRPs might be unclear, but the future of account-to-account payments powered by Open Banking is extremely bright. Use cases will open a new world in payments and banking – the landscape is going to change. Open banking is here to stay.

The silver lining - greater control and flexible payments right now

Now that you know non-sweeping VRPs are exciting and can unlock more commercial offerings and flexibility for your customers, you also recognise that it’s early doors. We’re currently working with banks to help define what non-sweeping VRPs will look like to ensure that it’s a win-win for all. But in the meantime, we’ve developed a solution – Request With Vyne.

With all the benefits of account-to-account payments, but made to work as an instalment model, Request With Vyne gives you the ability to provide customers with a much-needed flexible payment structure. No form of credit is given at any time with the customer simply choosing how and when they can pay straight from their bank account.

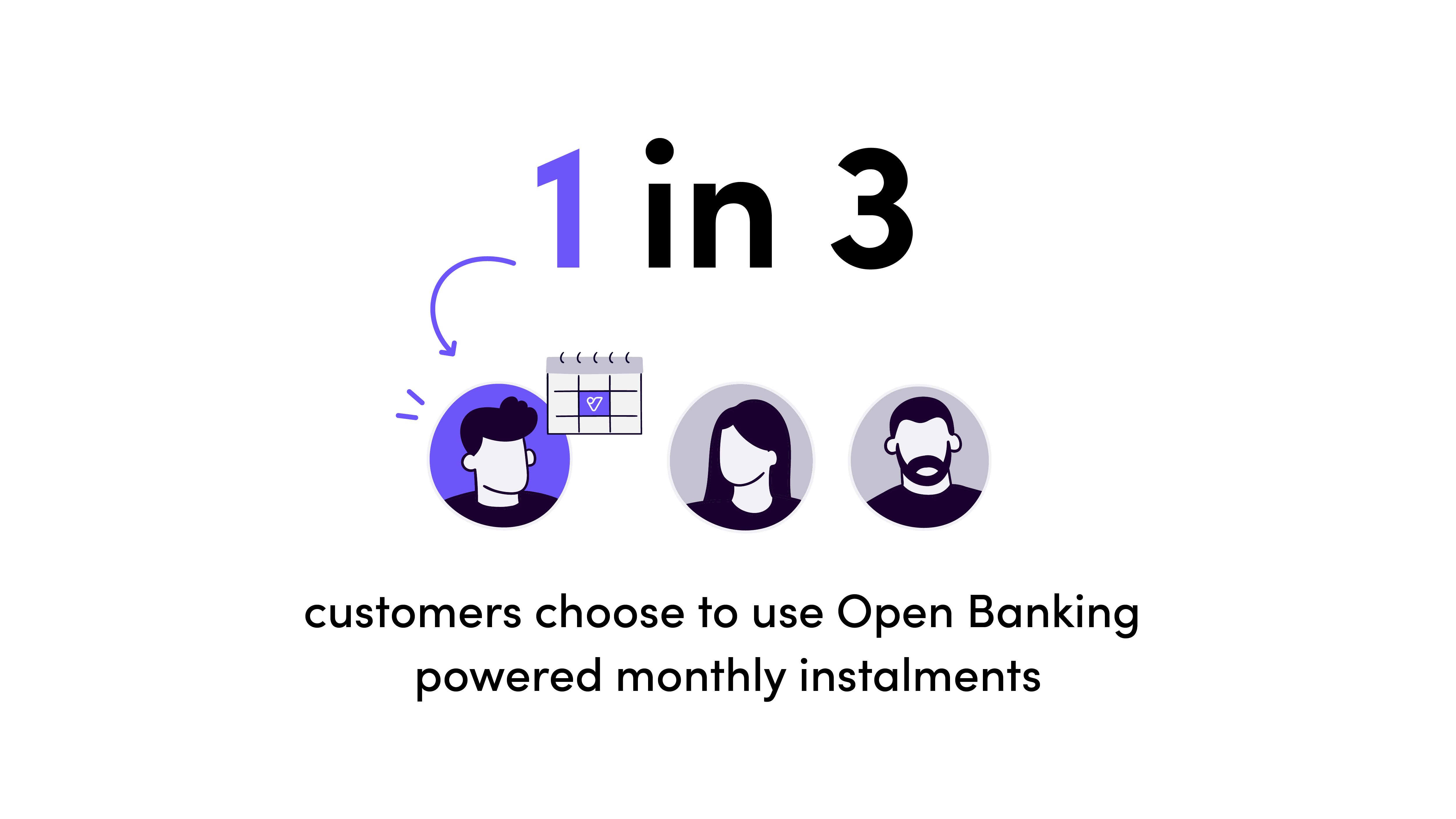

A successful soft launch has shown how you can help your customers prepare for the VRPs payment experience, diversify your product offering and increase brand sentiment.

“Consumers now expect a seamless checkout experience in a way that suits them. VRP can help address these challenges, but with some time until mass market availability we’re excited to bring friction-free checkout alongside flexible payment options to merchants today through Request with Vyne.”

How it works

MainstageWe worked with Mainstage Festivals to deliver a monthly instalment payment method, giving customers more flexibility when paying for their festival tickets. Instead of paying for their ticket in one go, customers can pay for the initial deposit and split the remainder over time, completing each payment using Vyne’s Pay with bank solution.

“Paying the final 50–70% in instalments is a real win for customers; it’s great that we can give customers the option of paying in instalments."

- Rob Tominey - Chairman + Co-Founder Mainstage Festivals