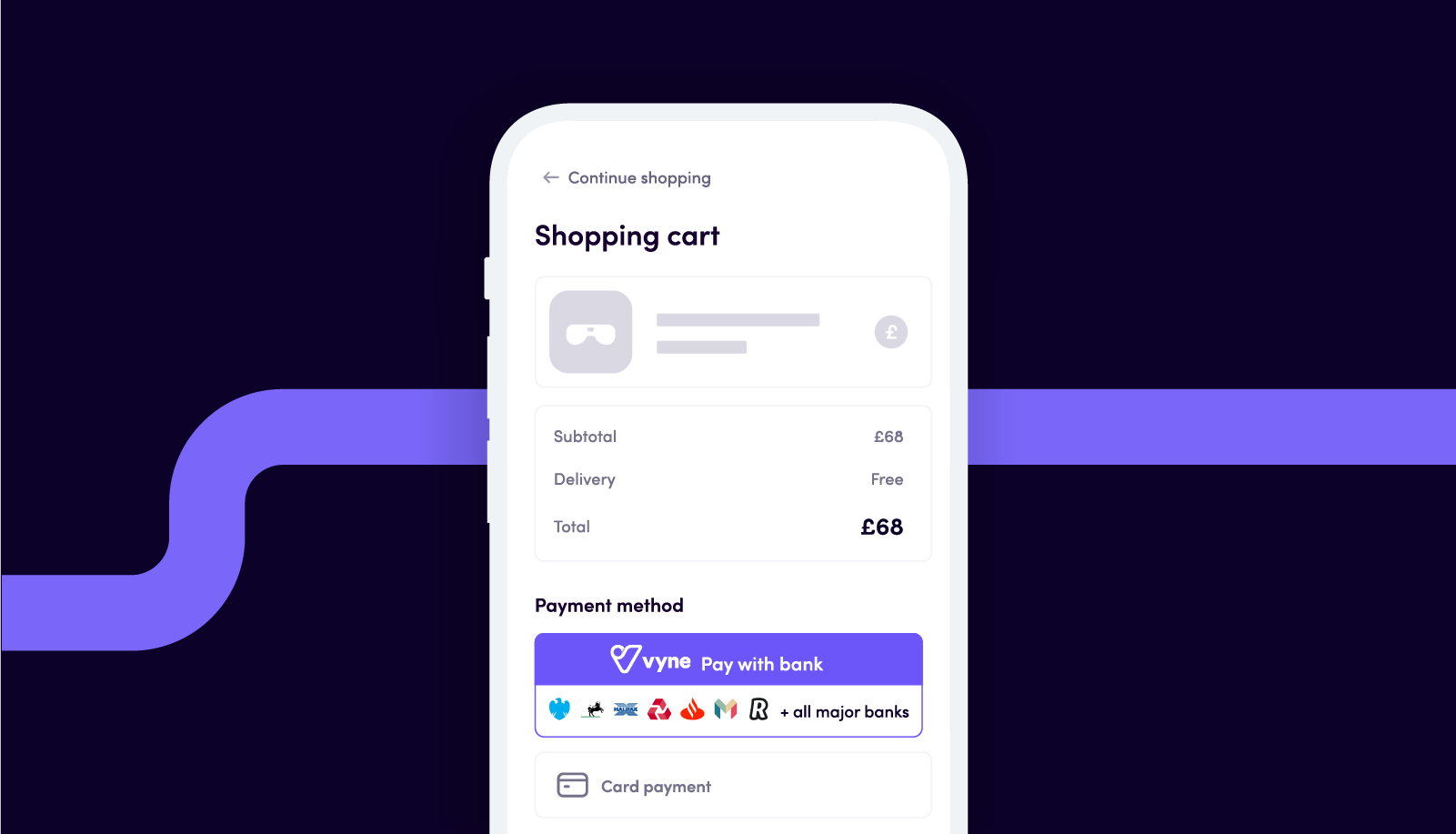

Pay with bank by Vyne

Fast, secure and easy payments from your bank account.

No cards. No downloads. No registration.

Payments perfected

Our brand community

We work with the brands you love to offer you a faster, easier and safer way to pay at checkout.

Fast and secure checkout

It's as easy as... one, two, three

Say hello to the easiest, safest way to pay and farewell to entering long card numbers. Every purchase is completed through your own banking app.

1

Check out with Vyne.

2

Select your banking app.

3

Confirm payment. Done.

The easiest way to make payments

Why Pay with bank by Vyne?

It's simple

No cards. No app. No registration. Log into your banking app, confirm the payment and you're done.

It's secure

Authorise payments with bank-level security, face and fingerprint ID.

It's fast

Make payments in as little as three taps. No details needed. Plus, you'll get instant refunds.

What Pay with bank customers are saying…

Do I need a Vyne account?

No. You don’t need to have a Vyne account or create one in order to make a payment.

How secure is Vyne?

Vyne uses your banks' own technology to enable you to pay faster, easier and safer. Without the risk of storing and sharing card details, you’re less likely to fall victim to fraud.

Is Vyne regulated by the FCA?

Yes. We are authorised and regulated by the Financial Conduct Authority (FCA) as an Authorised Payment Institution. Our reference number is 925649.

Do I have to manually enter the payee details?

No, once you've selected your bank, we’ll securely connect you and the merchant's details are pre-populated for you to approve the payment. This means there’s no risk of paying into the wrong account.

How safe is a Vyne payment compared to a card payment?

Unlike card payments, when you pay using Vyne you never have to input or share any card or bank information when you check out. This makes the likelihood of stolen details a lot less.

Are my payments protected with Vyne?

When you make a payment with Vyne you are protected under the Consumer Rights Act, this is the same protection you have when making payments by cash and debit card.

In the highly unlikely event that Vyne misdirects a payment, Vyne is liable to reimburse the payment under Financial Conduct Authority (FCA) regulation. You can find our FCA listing here.

In the instance of failure to deliver goods or if products are not as described, you will need to raise this directly with the merchant who should refund the item. Vyne enables merchants to offer instant refunds so that you don’t need to wait days for your funds to arrive back in your bank account.